S-Corporation

Why choose a S-Corporation?

- Limited liability protection: Both offer limited liability protection, so shareholders (owners) are typically not personally responsible for business debts and liabilities.

- Separate entities: Both the S corp and C corp are separate legal entities created by a state filing.

- Filing documents: Formation documents must be filed with the state. These documents, typically called the Articles of Incorporation or Certificate of Incorporation, are the same for both C and S corporations. Both have shareholders, directors and officers. Shareholders are the owners of the company and elect the board of directors, who in turn oversee and direct corporation affairs and decision-making but are not responsible for day-to-day operations. The directors elect the officers to manage daily business affairs.

- Corporate formalities: Both are required to follow the same internal and external corporate formalities and obligations, such as adopting bylaws, issuing stock, holding shareholder and director meetings, filing annual reports, and paying annual fees.

The Differences

- Taxation: is often considered the most significant difference for small business owners when evaluating S corporations vs. C corporations.

- C corporations: C corps are separately taxable entities. They file a corporate tax return (Form 1120) and pay taxes at the corporate level. They also face the possibility of double taxation if corporate income is distributed to business owners as dividends, which are considered personal income. Tax on corporate income is paid first at the corporate level and again at the individual level on dividends.

- S corporations: S corps are pass-through tax entities. They file an informational federal return (Form 1120S), but no income tax is paid at the corporate level. The profits/losses of the business are instead “passed-through” the business and reported on the owners’ personal tax returns. Any tax due is paid at the individual level by the owners.

- Personal Income Taxes: With both types of corporations, personal income tax is due both on any salary drawn from the corporation and from any dividends received from the corporation.

- Corporate Ownership: C corporations have no restrictions on ownership, but S corporations do.

- S corps: are restricted to no more than 100 shareholders, and shareholders must be US citizens/residents. S corporations cannot be owned by C corporations, other S corporations, LLCs, partnerships or many trusts. Also, S corporations can have only one class of stock (disregarding voting rights), while C corporations can have multiple classes. C corporations therefore provide a little more flexibility when starting a business if you plan to grow, expand the ownership or sell your corporation.

Package includes: Administrative, Federal & State Registration Fees...

- Consulting (1Hour)

- FEIN: Federal Employer Identification Number (Optional)

- Name Reservation

- Letter of Intent

- Articles of Incorporation

- Turnaround Time 7-10 Business Days

- Shipped Priority Mail

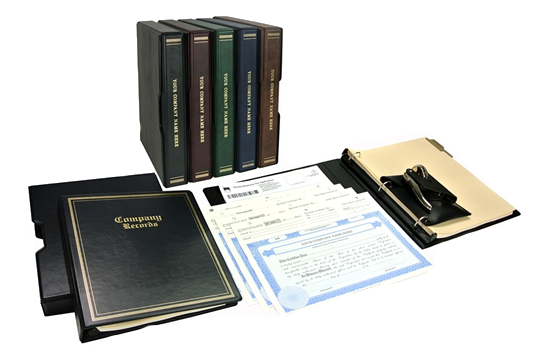

- Corporate Kit

- Membership Retainer (2 Hr. with Assigned Consultant)

Expedited Processing of Document Filings:

Any Domestic or Foreign Corporation, Limited Partnership, or Limited Liability Company Filing:

A document submitted to the GA Secretary of State (Only) for expedited filing will be reviewed and a filing response

indicating whether the document has been filed or rejected will be sent to the filer or contact person within

the time frame of the requested level of expedited service. The expedited fee is in addition to the regular

filing fee associated with the document type or service requested. The expedited review period is during

business hours only, and excludes weekends and state holidays.

- Regular Expedited Service $200.00

Review completed and a response sent to the filer within 48 hours after receipt,

excluding weekends and state holidays. - Same Day Expedited Service $500.00

Review completed and a response sent to the filer the same day as receipt.

Same day expedited processing service requests must be received by the

Division by noon of a business day. Documents received after noon will be

reviewed by noon on the next business day. - One Hour Expedited Service $1,500.00

Review completed and a response sent within one hour of receipt. One hour

expedited processing service requests are reviewed on business days between

9:00 a.m. and 4:00 p.m. Documents received outside of these business hours will

be reviewed on the next business day starting at 9:00 a.m.

The name, email address, and telephone number of a person authorized to make

corrections and to whom any questions regarding the document or service

requested may be directed must be provided.

Disclaimer: Crim Group is not an attorney or law firm and does not provide legal advice. Nothing in this information is intended nor should it be considered legal advice. We are not attorneys, we offer Legal Document Preparation to the public at their specific direction.